Troilus Drills 78.38 g/t AuEq Over 2 m, Including 153.73 g/t AuEq Over 1 m in the Southwest Zone

MONTREAL, June 17, 2025 (GLOBE NEWSWIRE) -- Troilus Gold Corp. (“Troilus” or the “Company”, TSX: TLG; OTCQX: CHXMF; FSE: CM5R) is pleased to announce the final assay results from the Southwest Zone (“Southwest”) as part of its ongoing 2025 Exploration Program (see February 4, 2025 press release) at its Troilus Project located in northcentral Quebec, Canada. The now concluded Southwest drill program focused on identifying and delineating higher-grade mineralization and enhancing confidence in the block model within the Southwest Zone as outlined in the May 2024 Feasibility Study (see May 14, 2024 press release).

The Southwest drill program produced impactful results that have confirmed and extended the continuity of higher-grade material within the Phase 1 reserve pit, which encompasses years 1 to 5 of the mine plan. All intercepts reported herein lie within the current mine plan and have the potential to support optimization of the early production schedule. All grades are uncut, and true thicknesses are approximately 75% to 90% of drilled length. Please refer to the press releases from April 29, 2025 and May 22, 2025 for additional results from the 2025 Exploration Program.

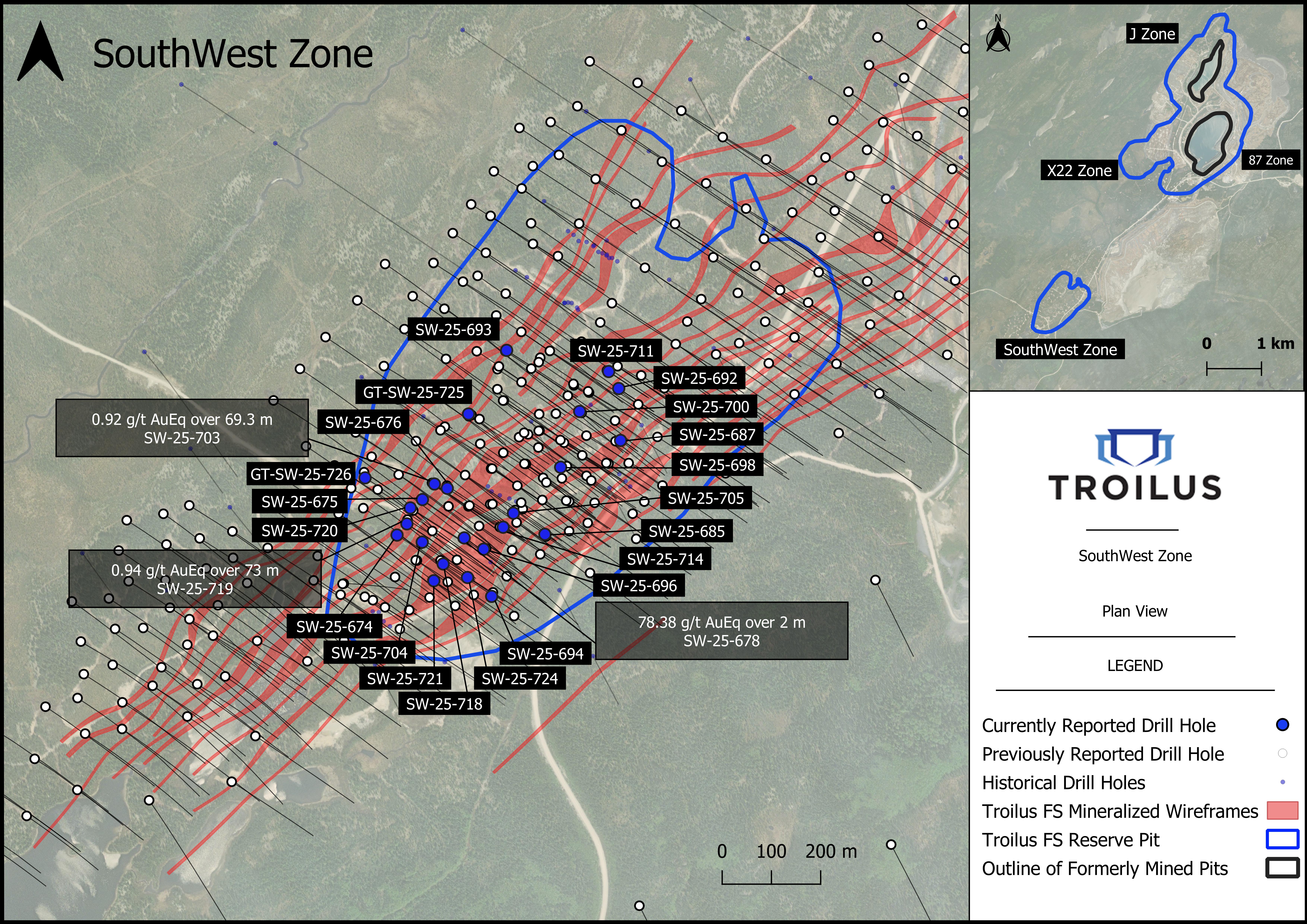

Southwest Intercept Highlights (see Figure 1):

-

Hole SW-25-678 intersected 78.38 g/t gold equivalent (“AuEq”) (78.21 g/t Au, 5.95 g/t Ag, 0.06 % Cu) over 2 m, including 153.73 g/t AuEq (153.50 g/t Au, 11.00 g/t Ag, 0.06 % Cu) over 1 m starting at 120m downhole. This narrow yet high grade intercept represents the single best assay from the Southwest zone to date.

-

Hole SW-25-719 intersected 0.94 g/t AuEq (0.88 g/t Au, 0.39 g/t Ag, 0.03 % Cu) over 73 m, including 2.62 g/t AuEq (2.50 g/t Au, 0.70 g/t Ag, 0.07 % Cu) over 1 m and 15.15 g/t AuEq (15.05 g/t Au, 1.05 g/t Ag, 0.05 % Cu) over 2 m starting at 137 m downhole.

-

Hole SW-25-703 intersected 0.92 g/t AuEq (0.73 g/t Au, 1.55 g/t Ag, 0.10 % Cu) over 69.3 m, including 20.93 g/t AuEq (20.90 g/t Au, 0.80 g/t Ag, 0.01 % Cu) over 1 m starting at 84 m downhole.

Justin Reid, CEO of Troilus, commented, “The 2025 drill campaign delivered exactly what we set out to achieve in providing greater confidence in the block model and the discovery of additional high grade mineralization. With Phase 1 of mining focused on the Southwest Zone in years 1-5, these newly identified high-grade ounces could be particularly impactful. Our geology team continues to interpret results and is confident in the opportunity for further growth. As we advance toward a construction decision, these results help de-risk the project and reinforces its long-term value.”

*The completed NI 43-101 technical report associated with the Troilus Project FS can be found on SEDAR+ at www.sedarplus.ca under the Company’s issuer profile or on the Company’s website at www.troilusgold.com

Southwest Drilling

Drill hole SW-25-678 returned 78.41 g/t AuEq over 2 metres including 153.80 g/t over 1 metre, which is the single highest assay returned from the Southwest since the start of drilling in 2019. This intercept is hosted within a highly sheared felsic porphyry unit with a visible gold-bearing, foliation-parallel quartz-pyrite-tourmaline vein. These veins are interpreted to be the result of an overprinting orogenic gold event, that also remobilized and redistributed mineralization from earlier volcano-magmatic events. It is this overprinting relationship and long history of mineralizing events that have contributed to the scale of the Troilus resource, which stands at 11.21 Moz AuEq in Indicated category, and 1.80 Moz AuEq in the Inferred category (see October 16, 2023 press release).

Drillholes SW-24-703 and 719 returned 0.92 g/t AuEq over 69.3 m and 0.94 g/t AuEq over 73 m, respectively. Both intercepts are hosted within a distinct brecciated and magnetic volcanic unit that is the dominant host to ore in the Southwest. These results confirm strong continuity of the primary ore zones in the Southwest.

Some of the exploration drill holes from the Southwest drill program served a dual purpose as geotechnical holes, providing valuable data that will be incorporated into the updated pit designs, further de-risking the earliest years of production.

Next Steps

The exploration team is now incorporating these final drill results into the Southwest resource model and is shifting its focus to near-site and regional field targets. A soil sampling program of approximately 3,700 samples is currently underway, and results are pending from a 2,100 line-kilometre versatile time-domain electromagnetic (“VTEM”) survey completed earlier this year.

The next phase of drilling is planned for the third quarter of 2025, targeting futher high-grade extensions in the Southwest and follow-up drilling of conceptual targets that lie outside current mine plans.

Figure 1. Plan map with the reported drill hole locations relative to the Southwest reserve pit

Table 1. Southwest Drill Results

| Hole | From (m) | To (m) | Interval (m) | Au Grade (g/t) | Cu Grade (%) | Ag Grade (g/t) | AuEq Grade (g/t) |

| SW-25-674 | |||||||

| 9 | 13 | 4 | 0.29 | 0.02 | 0.20 | 0.33 | |

| 21.8 | 26 | 4.2 | 0.55 | 0.03 | 0.44 | 0.64 | |

| 32 | 43 | 11 | 0.34 | 0.01 | 0.42 | 0.37 | |

| 48.5 | 62 | 13.5 | 0.21 | 0.05 | 0.51 | 0.31 | |

| 65 | 72 | 7 | 0.26 | 0.06 | 0.21 | 0.37 | |

| 79 | 94 | 15 | 0.46 | 0.03 | 0.11 | 0.49 | |

| 103 | 116 | 13 | 0.71 | 0.11 | 0.69 | 0.91 | |

| incl | 103 | 104 | 1 | 2.13 | 0.32 | 3.10 | 2.71 |

| incl | 111 | 112 | 1 | 1.95 | 0.33 | 2.30 | 2.53 |

| 122 | 179 | 57 | 0.63 | 0.03 | 0.41 | 0.69 | |

| incl | 145 | 146 | 1 | 4.82 | 0.00 | 0.00 | 4.83 |

| incl | 153 | 154 | 1 | 2.49 | 0.11 | 1.30 | 2.70 |

| incl | 162 | 163 | 1 | 2.92 | 0.05 | 3.00 | 3.04 |

| 207 | 212 | 5 | 3.30 | 0.04 | 0.44 | 3.38 | |

| 218 | 224 | 6 | 0.24 | 0.07 | 0.24 | 0.36 | |

| 236 | 239 | 3 | 0.17 | 0.08 | 0.67 | 0.32 | |

| SW-25-675 | |||||||

| 22 | 101 | 79 | 0.53 | 0.07 | 0.46 | 0.66 | |

| incl | 50 | 51 | 1 | 18.80 | 0.04 | 2.90 | 18.90 |

| 120 | 124 | 4 | 0.35 | 0.04 | 0.23 | 0.42 | |

| 131 | 213 | 82 | 0.44 | 0.03 | 0.36 | 0.46 | |

| incl | 135 | 136 | 1 | 3.46 | 0.64 | 7.00 | 4.62 |

| and | 196.9 | 197.5 | 0.6 | 9.50 | 0.01 | 0.50 | 9.52 |

| 230 | 246 | 16 | 0.21 | 0.07 | 0.51 | 0.33 | |

| 250 | 267 | 17 | 0.22 | 0.07 | 0.73 | 0.35 | |

| SW-25-676 | |||||||

| 15 | 25 | 10 | 0.26 | 0.03 | 0.45 | 0.33 | |

| 50 | 65 | 15 | 0.27 | 0.05 | 0.63 | 0.36 | |

| 79 | 80 | 1 | 2.08 | 0.10 | 1.20 | 2.27 | |

| 84 | 86 | 2 | 0.75 | 0.16 | 1.45 | 1.04 | |

| 117 | 161 | 44 | 0.36 | 0.02 | 0.29 | 0.40 | |

| 204 | 206.3 | 2.3 | 0.80 | 0.00 | 0.25 | 0.81 | |

| 212 | 215.5 | 3.5 | 0.17 | 0.09 | 1.14 | 0.33 | |

| 244.7 | 249 | 4.3 | 0.79 | 0.09 | 1.13 | 0.96 | |

| SW-25-678 | |||||||

| 12 | 14 | 2 | 0.76 | 0.04 | 0.45 | 0.84 | |

| 28 | 32 | 4 | 0.42 | 0.01 | 0.13 | 0.54 | |

| 38 | 42 | 4 | 0.35 | 0.00 | 0.15 | 0.36 | |

| 48 | 60 | 12 | 0.32 | 0.00 | 0.00 | 0.33 | |

| 80 | 83 | 3 | 0.20 | 0.12 | 1.87 | 0.42 | |

| 90 | 91 | 1 | 4.49 | 0.09 | 1.30 | 4.67 | |

| 120 | 122 | 2 | 78.21 | 0.06 | 5.95 | 78.38 | |

| incl | 120 | 121 | 1 | 2.91 | 0.07 | 0.90 | 3.03 |

| and | 121 | 122 | 1 | 153.50 | 0.06 | 11.00 | 153.73 |

| 153 | 158 | 5 | 0.14 | 0.13 | 1.68 | 0.38 | |

| SW-25-685 | |||||||

| 76 | 99 | 23 | 0.22 | 0.08 | 1.36 | 0.37 | |

| SW-25-687 | |||||||

| 7.5 | 20.5 | 13 | 0.50 | 0.04 | 0.53 | 0.58 | |

| incl | 7.5 | 8.5 | 1 | 1.79 | 0.17 | 2.10 | 2.09 |

| 52.5 | 69.5 | 17 | 0.21 | 0.05 | 0.77 | 0.31 | |

| 88.5 | 103.5 | 15 | 1.27 | 0.15 | 2.10 | 1.55 | |

| incl | 99.5 | 100.5 | 1 | 14.70 | 0.36 | 10.60 | 15.44 |

| 109.5 | 121.5 | 12 | 0.18 | 0.08 | 0.71 | 0.31 | |

| SW-25-692 | |||||||

| 26 | 28 | 2 | 0.49 | 0.00 | 0.00 | 0.50 | |

| 41 | 63 | 22 | 0.38 | 0.01 | 0.70 | 0.41 | |

| 69 | 80 | 11 | 2.49 | 0.00 | 0.05 | 2.50 | |

| incl | 75 | 76 | 1 | 23.20 | 0.00 | 0.60 | 23.21 |

| 99 | 107 | 8 | 0.49 | 0.03 | 0.66 | 0.54 | |

| 134 | 150 | 16 | 0.52 | 0.11 | 0.67 | 0.71 | |

| SW-25-693 | |||||||

| 77 | 84 | 7 | 0.28 | 0.01 | 0.19 | 0.31 | |

| 99 | 103 | 4 | 0.25 | 0.05 | 0.48 | 0.35 | |

| 170 | 171 | 1 | 1.99 | 0.10 | 2.60 | 2.18 | |

| 184 | 189 | 5 | 0.31 | 0.01 | 0.44 | 0.34 | |

| 195 | 197 | 2 | 2.74 | 0.24 | 4.95 | 3.21 | |

| 244 | 246 | 2 | 3.02 | 0.01 | 0.00 | 3.04 | |

| SW-25-694 | |||||||

| 20 | 23 | 3 | 0.31 | 0.05 | 0.63 | 0.40 | |

| SW-25-696 | |||||||

| 11 | 14 | 3 | 0.28 | 0.01 | 0.33 | 0.31 | |

| 23 | 43 | 20 | 0.27 | 0.05 | 0.49 | 0.36 | |

| 54 | 55 | 1 | 1.23 | 0.12 | 1.00 | 1.45 | |

| 65 | 68 | 3 | 0.23 | 0.09 | 0.77 | 0.38 | |

| 83 | 96 | 13 | 0.26 | 0.07 | 0.70 | 0.39 | |

| 113 | 123 | 10 | 0.27 | 0.14 | 2.06 | 0.52 | |

| SW-25-698 | |||||||

| 42 | 44 | 2 | 0.58 | 0.01 | 0.00 | 0.60 | |

| 55 | 63 | 8 | 0.45 | 0.05 | 0.39 | 0.54 | |

| 69 | 73 | 4 | 0.33 | 0.06 | 0.13 | 0.45 | |

| 84 | 87 | 3 | 0.35 | 0.01 | 0.23 | 0.38 | |

| 95 | 96 | 1 | 0.78 | 0.19 | 10.70 | 1.22 | |

| 113.6 | 120 | 6.4 | 0.22 | 0.09 | 0.95 | 0.38 | |

| 171 | 192 | 21 | 0.23 | 0.06 | 0.96 | 0.34 | |

| SW-25-700 | |||||||

| 24 | 28 | 4 | 0.33 | 0.02 | 0.00 | 0.38 | |

| 63 | 64 | 1 | 1.14 | 0.02 | 0.80 | 1.19 | |

| 123.3 | 157 | 33.8 | 0.50 | 0.08 | 0.58 | 0.63 | |

| 168.7 | 187 | 18.3 | 0.20 | 0.09 | 0.24 | 0.33 | |

| 201 | 222.55 | 21.55 | 0.35 | 0.12 | 1.51 | 0.58 | |

| incl | 211 | 212 | 1 | 2.69 | 0.28 | 4.40 | 3.21 |

| 232 | 243 | 11 | 0.22 | 0.10 | 1.90 | 0.40 | |

| SW-25-703 | |||||||

| 17 | 24 | 7 | 0.45 | 0.08 | 1.46 | 0.60 | |

| incl | 17 | 18 | 1 | 2.43 | 0.35 | 9.10 | 3.13 |

| 30 | 34 | 4 | 0.32 | 0.01 | 0.13 | 0.34 | |

| 77 | 81 | 4 | 0.36 | 0.01 | 0.00 | 0.39 | |

| 84 | 153.3 | 69.3 | 0.73 | 0.10 | 1.55 | 0.92 | |

| incl | 93 | 94 | 1 | 3.35 | 0.22 | 1.20 | 3.73 |

| and | 111 | 112 | 1 | 20.90 | 0.01 | 0.80 | 20.93 |

| 159 | 208 | 49 | 0.33 | 0.01 | 0.09 | 0.35 | |

| 215.3 | 218 | 2.8 | 0.37 | 0.03 | 0.27 | 0.39 | |

| 221 | 226 | 5 | 0.51 | 0.05 | 0.88 | 0.59 | |

| SW-25-704 | |||||||

| 12 | 24 | 12 | 0.52 | 0.07 | 0.37 | 0.64 | |

| 31 | 36 | 5 | 0.95 | 0.04 | 0.12 | 1.02 | |

| incl | 34 | 35 | 1 | 2.50 | 0.02 | 0.00 | 2.54 |

| 82 | 158 | 76 | 0.56 | 0.04 | 0.57 | 0.65 | |

| incl | 121 | 122 | 1 | 2.59 | 0.02 | 0.50 | 2.64 |

| and | 132 | 133 | 1 | 2.44 | 0.05 | 0.70 | 2.53 |

| and | 141 | 147 | 6 | 2.38 | 0.16 | 2.59 | 2.67 |

| and | 145 | 146 | 1 | 5.91 | 0.34 | 5.70 | 6.55 |

| 170 | 178 | 8 | 0.20 | 0.09 | 0.88 | 0.36 | |

| 202.1 | 204 | 1.9 | 0.51 | 0.28 | 3.25 | 1.00 | |

| SW-25-705 | |||||||

| 7 | 16 | 9 | 0.54 | 0.01 | 0.06 | 0.57 | |

| 23 | 25 | 2 | 0.51 | 0.01 | 0.00 | 0.54 | |

| 47 | 54 | 7 | 0.96 | 0.02 | 0.73 | 1.01 | |

| 71 | 72 | 1 | 1.17 | 0.00 | 0.60 | 1.18 | |

| 202 | 204 | 2 | 5.78 | 0.03 | 1.30 | 5.84 | |

| incl | 202 | 203 | 1 | 11.05 | 0.05 | 2.60 | 11.16 |

| SW-25-711 | |||||||

| 49 | 52 | 3 | 0.32 | 0.04 | 0.57 | 0.39 | |

| 59 | 61 | 2 | 1.54 | 0.23 | 6.65 | 2.00 | |

| 103 | 104 | 1 | 1.21 | 0.00 | 0.00 | 1.22 | |

| 113 | 130 | 17 | 0.58 | 0.01 | 0.19 | 0.60 | |

| incl | 126 | 127 | 1 | 3.22 | 0.00 | 0.00 | 3.23 |

| 167 | 169 | 2 | 0.54 | 0.00 | 0.00 | 0.55 | |

| SW-25-714 | |||||||

| 12 | 21 | 9 | 0.73 | 0.01 | 0.00 | 0.74 | |

| incl | 18 | 19 | 1 | 5.14 | 0.00 | 0.00 | 5.15 |

| 39 | 43 | 4 | 0.31 | 0.01 | 14.63 | 0.51 | |

| 51 | 53 | 2 | 2.23 | 0.03 | 0.00 | 2.28 | |

| 66 | 67 | 1 | 3.45 | 0.26 | 5.40 | 3.95 | |

| 76 | 88 | 12 | 0.28 | 0.04 | 0.26 | 0.35 | |

| 131 | 134 | 3 | 0.23 | 0.07 | 1.00 | 0.36 | |

| 169 | 172 | 3 | 0.17 | 0.11 | 2.00 | 0.37 | |

| SW-25-718 | |||||||

| 10 | 37 | 27 | 0.40 | 0.06 | 0.72 | 0.51 | |

| 46 | 56 | 10 | 0.71 | 0.03 | 0.34 | 0.76 | |

| 62 | 74 | 12 | 0.34 | 0.02 | 0.09 | 0.37 | |

| 95 | 113 | 18 | 0.18 | 0.07 | 0.46 | 0.30 | |

| 125 | 129 | 4 | 0.21 | 0.06 | 0.30 | 0.31 | |

| 168 | 173 | 5 | 0.43 | 0.01 | 0.10 | 0.46 | |

| 179 | 180 | 1 | 2.19 | 0.00 | 0.00 | 2.20 | |

| SW-25-719 | |||||||

| 20 | 67 | 47 | 0.70 | 0.04 | 0.23 | 0.77 | |

| incl | 59 | 65 | 6 | 2.64 | 0.03 | 0.10 | 2.69 |

| 73 | 75 | 2 | 0.57 | 0.17 | 1.45 | 0.87 | |

| 92 | 109 | 17 | 0.41 | 0.05 | 0.12 | 0.50 | |

| 126 | 128 | 2 | 0.60 | 0.29 | 1.80 | 1.12 | |

| 137 | 210 | 73 | 0.88 | 0.03 | 0.39 | 0.94 | |

| incl | 183 | 184 | 1 | 2.50 | 0.07 | 0.70 | 2.62 |

| and | 196 | 198 | 2 | 15.05 | 0.05 | 1.05 | 15.15 |

| 224 | 225.3 | 1.3 | 2.14 | 0.00 | 0.00 | 2.15 | |

| 231 | 239 | 8 | 0.19 | 0.10 | 0.80 | 0.38 | |

| SW-25-720 | |||||||

| 31.1 | 113 | 81.9 | 0.33 | 0.06 | 0.39 | 0.45 | |

| 119 | 122 | 3 | 0.25 | 0.06 | 0.00 | 0.36 | |

| 136 | 138 | 2 | 0.86 | 0.00 | 0.00 | 0.87 | |

| 151 | 153 | 2 | 1.22 | 0.01 | 0.00 | 1.24 | |

| 170 | 197 | 27 | 0.40 | 0.06 | 0.71 | 0.52 | |

| incl | 180 | 181 | 1 | 3.34 | 0.21 | 3.10 | 3.74 |

| 205 | 244 | 39 | 0.51 | 0.04 | 0.45 | 0.60 | |

| incl | 219 | 220 | 1 | 9.89 | 0.02 | 1.10 | 9.93 |

| SW-25-721 | |||||||

| 8 | 19 | 11 | 0.51 | 0.04 | 0.67 | 0.59 | |

| 26 | 44 | 18 | 0.37 | 0.03 | 0.22 | 0.42 | |

| incl | 30 | 31 | 1 | 2.50 | 0.01 | 0.00 | 2.52 |

| 58 | 67 | 9 | 0.41 | 0.16 | 1.03 | 0.69 | |

| 73 | 78 | 5 | 0.23 | 0.07 | 0.40 | 0.35 | |

| 172 | 173 | 1 | 1.04 | 0.01 | 0.00 | 1.06 | |

| SW-25-724 | |||||||

| 6 | 14 | 8 | 0.27 | 0.02 | 0.31 | 0.32 | |

| 26 | 33 | 7 | 0.66 | 0.15 | 2.66 | 0.95 | |

| incl | 29 | 30 | 1 | 2.33 | 0.64 | 13.00 | 3.56 |

| 57 | 64 | 7 | 0.22 | 0.05 | 0.67 | 0.32 | |

| GT-SW-25-725 | |||||||

| 8.8 | 31 | 22.3 | 0.38 | 0.13 | 0.53 | 0.60 | |

| 91 | 92 | 1 | 0.66 | 0.02 | 14.20 | 0.87 | |

| 113 | 114 | 1 | 1.37 | 0.16 | 0.90 | 1.64 | |

| 143 | 151 | 8 | 1.18 | 0.06 | 1.69 | 1.30 | |

| incl | 147 | 148 | 1 | 5.75 | 0.00 | 0.60 | 5.76 |

| 171 | 194 | 23 | 0.50 | 0.15 | 1.19 | 0.77 | |

| incl | 172 | 173 | 1 | 2.35 | 0.20 | 6.50 | 2.76 |

| and | 183 | 189 | 6 | 0.80 | 0.32 | 1.80 | 1.35 |

| 204 | 205 | 1 | 1.35 | 0.01 | 0.25 | 1.36 | |

| 224 | 252 | 28 | 0.57 | 0.09 | 0.54 | 0.74 | |

| incl | 225 | 237 | 12 | 0.93 | 0.14 | 0.73 | 1.18 |

| GT-SW-25-726 | |||||||

| 106 | 107 | 1 | 2.93 | 0.01 | 14.70 | 3.12 | |

| 127 | 138 | 11 | 0.35 | 0.01 | 0.05 | 0.38 | |

| 149 | 153 | 4 | 0.49 | 0.03 | 0.00 | 0.54 | |

| 158.6 | 179 | 20.4 | 0.35 | 0.05 | 0.33 | 0.44 | |

| 186 | 190 | 4 | 0.34 | 0.02 | 0.00 | 0.38 | |

| 199 | 200 | 1 | 12.80 | 0.01 | 0.60 | 12.82 | |

| 206 | 212 | 6 | 0.32 | 0.05 | 0.28 | 0.40 | |

| 221 | 238 | 17 | 0.79 | 0.10 | 0.42 | 0.98 | |

| incl | 232 | 233 | 1 | 7.82 | 0.15 | 0.90 | 8.09 |

| 276 | 281 | 5 | 0.57 | 0.01 | 0.00 | 0.55 | |

| 290 | 300.1 | 10.1 | 1.63 | 0.01 | 0.00 | 1.65 | |

| incl | 292 | 293 | 1 | 3.49 | 0.03 | 0.00 | 3.54 |

| and | 298 | 299 | 1 | 7.93 | 0.01 | 0.00 | 7.95 |

* AuEq = Au + 1.6823 x Cu + 0.0124 x Ag

Quality Assurance and Control

During the drill program, one meter assay samples were taken from NQ core and sawed in half. One-half was sent for assaying at ALS Laboratory, a certified commercial laboratory, and the other half was retained for results, cross checks, and future reference. A strict QA/QC program was applied to all samples; which included insertion of one certified mineralized standard and one blank sample in each batch of 25 samples. Every sample was processed with standard crushing to 85% passing 75 microns on 500 g splits. Samples were assayed by one-AT (30 g) fire assay with an AA finish and if results were higher than 3.5 g/t Au, assays were redone with a gravimetric finish. For QA/QC samples, a 50 g fire assay was done. In addition to gold, ALS laboratory carried out multi-element analysis for ME-ICP61 analysis of 33 elements four acid ICP-AES.

Qualified Person

The technical and scientific information in this press release has been reviewed and approved by Nicolas Guest, P.Geo., Exploration Manager, who is a Qualified Person as defined by NI 43-101. Mr. Guest is an employee of Troilus and is not independent of the Company under NI 43-101.

AuEq Disclosure

The formulas used to calculate equivalent values for resources are as follows, for 87 Pit AuEq = Au + 1.5628*Cu +0.0128 *Ag, for J Pit AuEq = Au + 1.5107*Cu +0.0119 *Ag, for SW Pit AuEq = Au + 1.6823*Cu +0.0124 *Ag, for X22 Pit AuEq = Au + 1.5628*Cu +0.0128 *Ag. AuEq was calculated using metal prices of $1,850/oz Au; $4.25/lb Cu and $23.00/oz Ag.

About Troilus Gold Corp.

Troilus Gold Corp. is a Canadian development-stage mining company focused on the systematic advancement of the former gold and copper Troilus Mine towards production. Troilus is located in the tier-one mining jurisdiction of Quebec, Canada, where it holds a large land position of 435 km² in the Frôtet-Evans Greenstone Belt. A Feasibility Study completed in May 2024 supports a large-scale 22-year, 50ktpd open-pit mining operation, positioning it as a cornerstone project in North America.

For more information:

Caroline Arsenault

VP Corporate Communications

+1 (647) 407-7123

info@troilusgold.com

Cautionary Note Regarding Forward-Looking Statements and Information

This press release contains “forward-looking statements” within the meaning of applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements regarding the impact of the drill results on the Company, the results of the FS and the timing of the supporting technical report to be filed, including, without limitation various project economics, financial and operational parameters such as the timing and amount of future production from the Project, expectations with respect to the IRR, NPV, payback and costs of the Project, anticipated mining and processing methods of the Project; proposed infrastructures, anticipated mine life of the Project, expected recoveries and grades, timing of future studies including the environmental assessments (including the timing of an environmental impact study) and development plans, opportunity to expand the scale of the project, the project becoming a cornerstone mining project in Noth America; the development potential and timetable of the project; the estimation of mineral resources and reserves; realization of mineral resource and reserve estimates; the timing and amount of estimated future exploration; costs of future activities; capital and operating expenditures; success of exploration activities; the anticipated ability of investors to continue benefiting from the Company’s low discovery costs, technical expertise and support from local communities, the timing and amount of estimated future exploration; and the anticipated results of the Company’s 2024 drill program and their possible impact on the potential size of the mineral resource estimate. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “continue”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements are made based upon certain assumptions and other important facts that, if untrue, could cause the actual results, performances or achievements of Troilus to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Troilus will operate in the future. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, amongst others, currency fluctuations, the global economic climate, dilution, share price volatility and competition. Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of Troilus to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: there being no assurance that the exploration program or programs of the Company will result in expanded mineral resources; risks and uncertainties inherent to mineral resource and reserve estimates; the high degree of uncertainties inherent to feasibility studies and other mining and economic studies which are based to a significant extent on various assumptions; variations in gold prices and other metals, exchange rate fluctuations; variations in cost of supplies and labour; receipt of necessary approvals; availability of financing for project development; uncertainties and risks with respect to developing mining projects; general business, economic, competitive, political and social uncertainties; future gold and other metal prices; accidents, labour disputes and shortages; environmental and other risks of the mining industry, including without limitation, risks and uncertainties discussed in the Company’s latest Annual Information Form, its technical reports and other continuous disclosure documents of the Company available under the Company’s profile at www.sedarplus.ca. Although Troilus has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Troilus does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/751ed87f-badd-483b-ba09-6b2049d7e205

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.